Credit Card Debt on The Rise

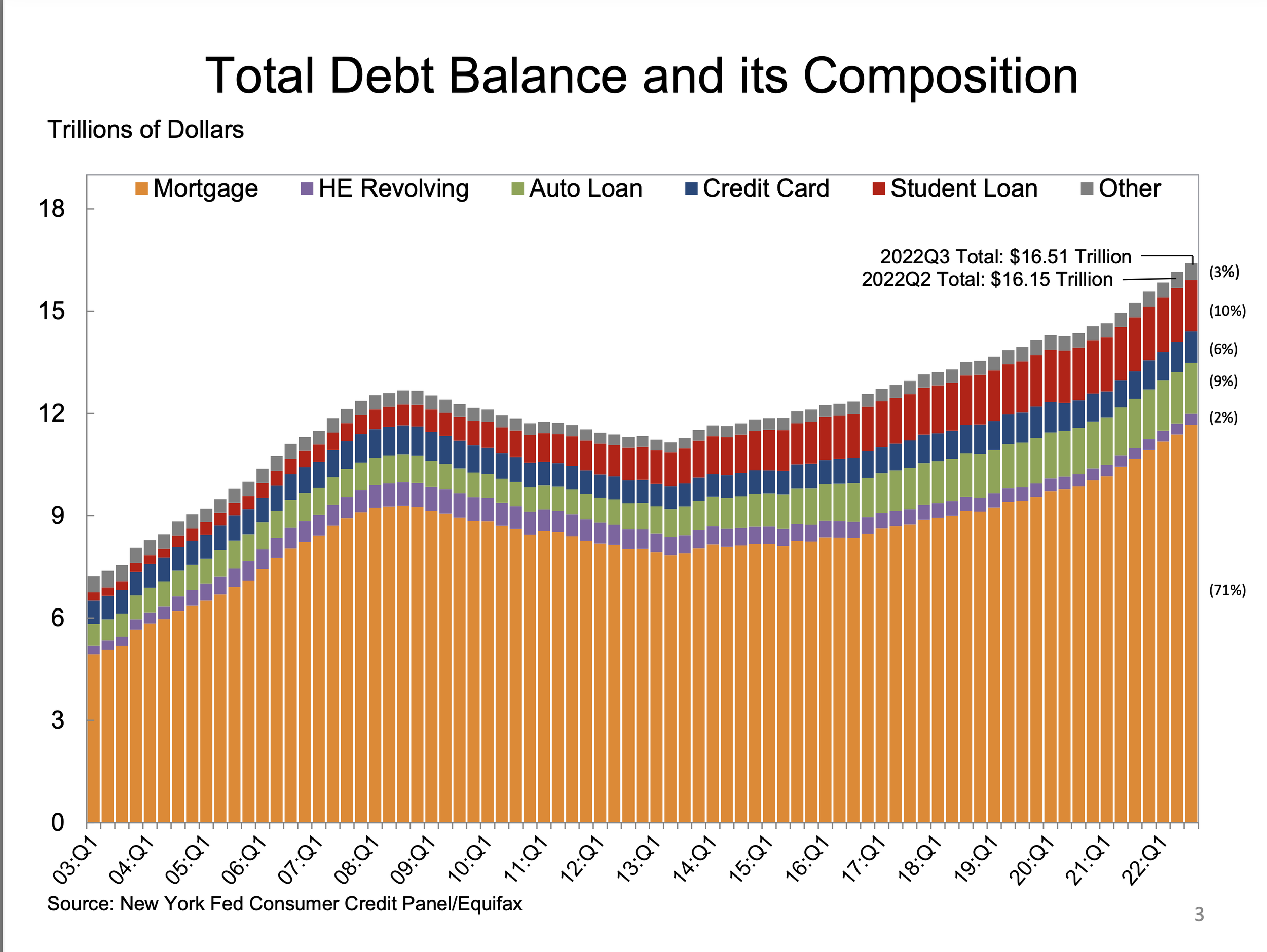

Credit card debt increased by 18% in the third quarter of 2022. A new report by the Federal Reserve Bank of New York, finds that household consumption has caused credit card debt to increase at a faster rate than experienced in the past 18 years. Total consumer debt increased from $16.15 to $16.51 Trillion Dollars between the second and third quarters of 2022. The majority of the debt is in mortgages (71%), followed by student debt (10%) and Auto loans (9%). Credit Card debt make up 6% of debt balances.

What is causing the increase in credit card usage?

Economists have a couple of possible explanations. It can be an increase in demand or an increase in prices.

“Credit card, mortgage, and auto loan balances continued to increase in the third quarter of 2022 reflecting a combination of robust consumer demand and higher prices,” said Donghoon Lee, economic research advisor at the New York Fed. “However, new mortgage originations have slowed to pre-pandemic levels amid rising interest rates.”

My view is that spending hasn’t changed. What has changed is that we have depleted our savings that we accumulated over the pandemic and now starting to dip into debt again.

Citation

Andrew Haughwout, Donghoon Lee, Daniel Mangrum, Joelle Scally, and Wilbert van der Klaauw, “Balances Are on the Rise—So Who Is Taking on More Credit Card Debt?,” Federal Reserve Bank of New York Liberty Street Economics, November 15, 2022, https://libertystreeteconomics.newyorkfed.org/2022/11/balances-are-on-the-rise-so-who-is-taking-on-more-credit-card-debt/.