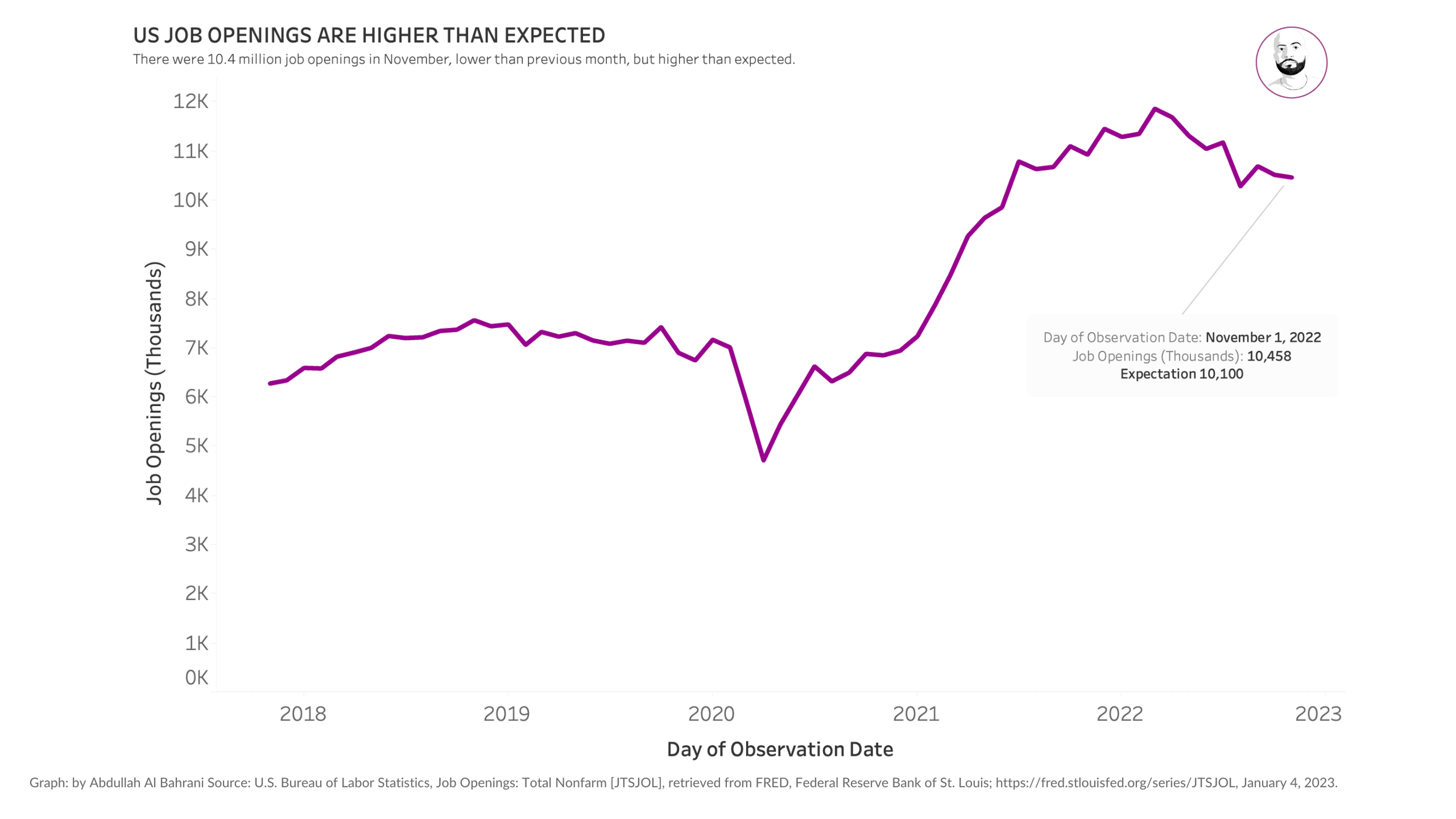

A Recession Without Unemployment?

The Federal Reserve has been increasing interest rates to reduce inflationary pressure. Most economics introductory textbooks predict that the Fed’s actions would put pressure on the labor market. It should reduce firm’s willingness to hire, which would show up in the data as a decrease in Job Openings. This will eventually lead to an increase in the unemployment rate as more people are laid off and begin searching for jobs in an economy with fewer job openings.

This relationship has not held this time around. The data shows that there were 10.4 million job openings in November. Although the number of openings has decreased, it isn’t decreasing as fast as is expected. The market expectations for the November report was 10.1 million openings. There were 300K more openings than expected!

The unemployment rate for December 2022 was released today. The rate fell from 3.6 to 3.5%, and payroll data indicated an increase of 223,000 jobs! The market expectation was an unemployment rate of 3.7% and 200,000 new jobs. The labor market is exceeding expectations across the board.

Why?

There are a couple of hypotheses of why the market is not responding as expected.

The lag- The unemployment rate is a lagging indicator. Meaning that it can take several months for economic changes to appear in the data.

Too many job openings- We might continue to see a decrease in the job openings, but unemployment rate might not increase. The large number of job openings makes it easier for the labor market to absorb employees as they are laid off from work.

Oman’s biggest economic challenge can be explained with one graph. Learn more about it here.

Innovation does not happen without failure. Give people the confidence to fail.

A new report shows that the cost of inflation is not even across the population.

Developing a growth mindset in class is critical for success. As professors, our role is to model that mindset.

Canned seafood experienced a shift in demand due to TikTok Trend. A new example for all economic educators.

Tips for students studying economics and details on how to build your career.

A new paper uses high-frequency rideshare data to examine racial bias in traffic stops. This research is novel because it solves problems that other researchers in this area have never been able to.

How are you building community and a sense of belonging in your class?

Most New Year’s resolutions fail. I explain the behavioral economics behind why.

New data shows that the U.S labor market remains resilient even as the Federal Reserve increases interest rates.

We need to teach our students how to bounce back from failure, but our rigid academic environment doesn't provide the flexibility needed to incorporate these lessons into our classes.